Active share calculation

Take the sum of the differences. For each fund Active Share is also.

Net Asset Value Nav Formula And Nav Per Share Calculation

The Active Share displayed in this panel is computed relative to the primary benchmark declared in the funds prospectus ie the Prospectus Benchmark.

. Possible sources of active share within a portfolio. Active Share can most easily be calculated as 100 minus the. Including stocks that are not in the benchmark Excluding stocks that are in the benchmark Holding.

By disclosing their active share calculation fund managers will allow investors to better determine whether a high-fee actively managed fund is. Active Share can most easily be calculated as 100 minus the sum of the overlapping portfolio weights. Make all values of differences as positive.

Active Share ½ P x B x sum for all portfolio and benchmark holdings absolute value P x portfolio. For each fund Active Share is also. This is defined as active_share_.

Difference of weight in the portfolio and benchmark. I have a simple calculation formula eg. The Active Share displayed in this panel is computed relative to the primary benchmark declared in the funds prospectus ie the Prospectus Benchmark.

Weights and a spreadsheet can make the calculation in a few minutes. Mathematically it is calculated as the sum of the difference between the weight of. Active share measures how much an equity portfolios holdings differ from the benchmark index constituents.

The smaller the active share percentage the more closely it resembles the. While conventional wisdom is that top-heavy cap-weighted indices represent more. Active Share of 76 highlights the importance that the benchmark plays in the Active Share calculation.

Equity-only active-share calculations should not be permitted and because they would lower the active-share result most managers should be pleased to conform to this. Sources of portfolio active share. An academic study conducted by researchers from Yale in 2006.

The active-share study examined the proportion of stock holdings in a mutual funds. Hi I have an excel file that shared on teams. Active Share The sum value of.

This is defined as active_share_ij active_share_ji sumN_k omegak_i - omegak_j where N is the number of all stocks that exist in the market omegak_i is the weight of stock k. A2-B2 this cells contain 24h time list so I can calculate the working hours. Active share is a measure of the difference between a portfolios holdings and its benchmark index.

Here are some examples to illustrate how Active Share. Last month the New York attorney generals office published a letter recommending that investors in actively managed stock funds consult a calculation called. The greater the active share percentage the more the fund deviates from its benchmark.

What Startups Should Know About Monthly Active Users Mau Baremetrics

![]()

How To Measure Active Users And Everything You Need To Know

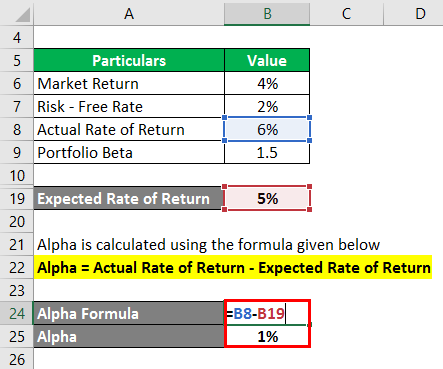

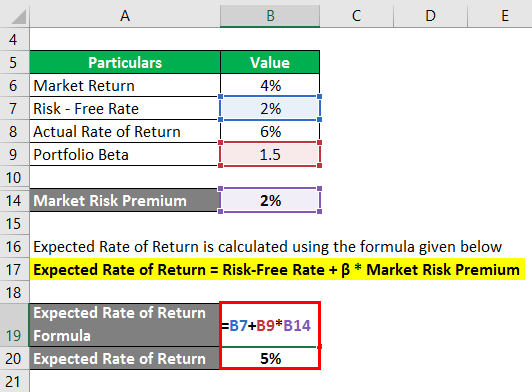

Alpha Formula Calculator Examples With Excel Template

/dotdash_Final_Calculating_the_Equity_Risk_Premium_Dec_2020-01-1ff6e59964b9408d9ac7d175f8ad1292.jpg)

Calculating The Equity Risk Premium

![]()

How To Measure Active Users And Everything You Need To Know

Free Float Market Capitalization Formula How To Calculate

16 Key Social Media Metrics To Track In 2022 Benchmarks

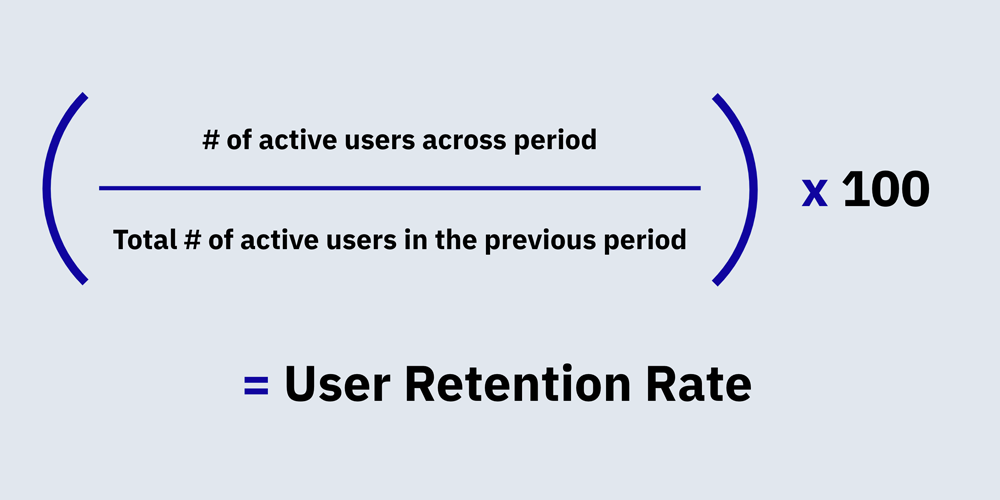

How To Calculate Retention Rate In B2b Saas

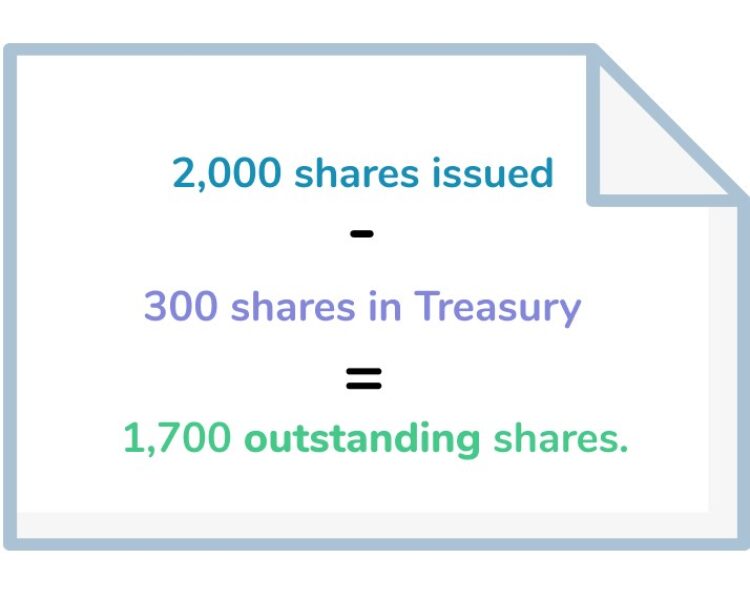

Shares Outstanding Meaning Formula Investinganswers

Alpha Formula Calculator Examples With Excel Template

.jpg)

Shares Outstanding Meaning Formula Investinganswers

:max_bytes(150000):strip_icc()/dotdash_Final_Calculating_the_Equity_Risk_Premium_Dec_2020-01-1ff6e59964b9408d9ac7d175f8ad1292.jpg)

Calculating The Equity Risk Premium

:max_bytes(150000):strip_icc()/stock-market-836262076-94c0b0ab5d2b4b7788fddf178abc0c3d.jpg)

Active Share Measures Active Management

Alpha Formula Calculator Examples With Excel Template

Information Ratio Financial Edge

How To Calculate Intrinsic Value Of A Share Various Valuation Methods

Market Share Formula And Percentage Calculator Excel Template